How To Improve Your Financial Situation

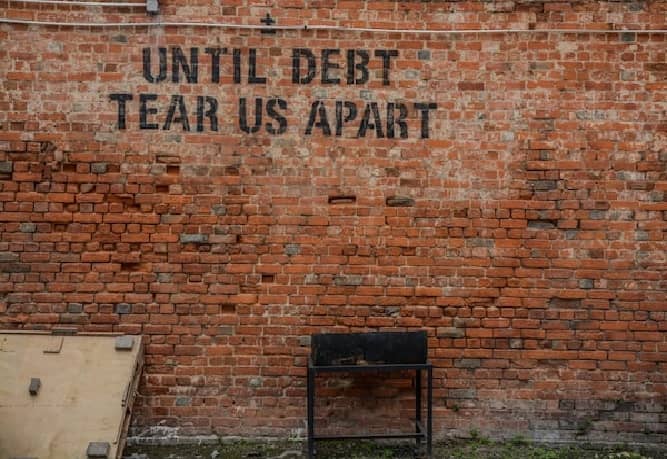

Improving your financial situation can be a tough task, but it is something that is absolutely necessary for anyone looking to achieve their long-term goals. One of the biggest obstacles that people face when trying to improve their finances is their mindset. Many people simply don’t believe that they can achieve their financial goals, or they believe that they are too far behind to ever catch up. This negative mindset can hold you back and prevent you from taking the necessary actions to improve your financial situation.

However, with the right mindset and strategies, anyone can improve their financial situation:

Handle any debt.

One approach is to seek help from a debt relief company like Citizens Debt Relief. These companies offer debt management plans to help you pay off your debt gradually and at a lower interest rate. It’s essential to understand the terms and conditions of the program before signing up, as some companies may have upfront fees or higher monthly payments, which could defeat the purpose of reducing your debt. Additionally, ensure that the company is legitimate and has a good reputation to avoid falling into a scam.

Consider a new career path.

Another way to improve your financial situation is to start a new career. A career change can mean more opportunities for better pay and benefits, promotion, or a more meaningful career path. However, changing careers can be challenging and require time and resources. If you decide to switch careers, consider taking courses or going back to school to acquire new skills and knowledge, network with people in your desired industry to learn about job opportunities, and update your resume to highlight your transferable skills. For instance, someone who’d like to own their own restaurant someday might start by seeking the best program in the culinary arts Los Angeles has to offer.

Build yourself a budget.

In today’s economic climate, budgeting and saving have never been more important for your financial stability. It is essential to get a clear understanding of your current expenses, earnings, and goals to develop a realistic budget. Begin by calculating your monthly expenses, including everything from rent or mortgage to groceries, utilities, phone bill, and any other recurring payments. Once you have a clear idea of your monthly cash flows, it’s easier to identify areas where you can save.

Start to save.

Incorporating savings as a part of your budget is also crucial. Aim to save at least 20% of your income. Having a savings cushion can help you feel more secure in times of economic instability, and it can protect you against unexpected expenses such as medical emergencies or job loss. In summary, budgeting and saving are vital components for achieving financial stability. Once you’ve developed a budget and savings plan that works for you, consistent implementation will ensure that you stay on track and meet your financial goals.

Cut costs wherever you can.

In today’s world, saving money has become an essential part of our lives. Every penny saved can contribute towards our financial goals and help us achieve financial stability. One way to save money is to look for opportunities to reduce expenses on things we use every day, such as utility bills, transportation, groceries, and shopping expenses. These small adjustments to our daily routines can add up to significant savings over time, helping us achieve financial stability and security.

Money is an essential part of our everyday lives, and managing our financial life is a crucial skill that can have a significant impact on our lives. Unfortunately, many people struggle with their finances, and it can seem overwhelming to try and take control of them. However, implementing these practical strategies can help you take charge of your finances and work towards a better financial future.